ALHUDA CIBE

AlHuda Centre of Islamic Banking and Economics is working diligently since 2005. AlHuda CIBE has been acknowledged as a distinguished service provider due to our notable services, team of dedicated professionals and one stop solutions of interest-free Banking and Finance. Our aim is to provide state-of-the-art services of interest-free banking and finance. We are proud to be prominent for our Advisory and consultancy, research and development, education and capacity building, Shariah advisory, publication and events all over the world.

AlHuda CIBE is supported by many national and international organizations and institutions as Strategic Partners support and our Alumni have spread over 98 countries. We are proud to stand among world's largest presences for capacity building, trainings, consultancy and other services. More details are available at www.alhudacibe.com

ABOUT PAKISTAN MICROFINANCE NETWORK

The Pakistan Microfinance Network (PMN or ‘the Network’), the national association for retail players in the microfinance industry, was established as an informal group by industry practitioners in 1997, under the name Microfinance Group-Pakistan [MFG-P]. At the time, the group was focused on coordinating dialogue and lateral learning opportunities between members. Over time, with the increase in the nature and level of activities, and membership, the setup was registered with the Securities and Exchange Commission [SECP] in April 2001 under the Companies Act. It has since been known as the Pakistan Microfinance Network. Currently the network strength stands at 44 Microfinance Providers including Microfinance Banks (regulated by SBP) and Non-Bank Microfinance companies (regulated by SECP). More details are available at www.pmn.org.pk/

ABOUT ISLAMIC MICROFINANCE NETWORK

Islamic Microfinance Network (IMFN) aims to bring forth Islamic micro-finance and Shariah compliant financial tools as a mechanism to eradicate poverty. Therefore, IMFN serves as a platform for Islamic micro-finance practitioners to jointly work for strengthening of the industry. More Details are available at www.imf-network.com

ABOUT WING:

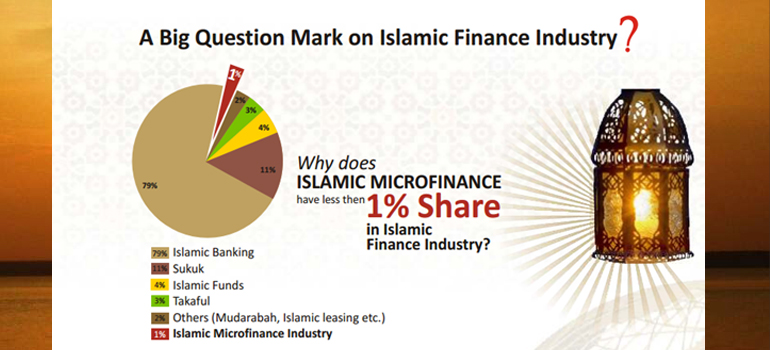

ISLAMIC MICROFINANCE

The issue of poverty has been a focus of international community. Everybody is talking about poverty reduction and different measures are suggested for this purpose. People living in poverty need rapid access to a diverse range of financial services to run their businesses, build assets, ensure smooth self-consumption, and manage risks. Financial services for poor people have proven to be a powerful instrument for reducing poverty, enabling them to build assets, increase incomes and reduce their vulnerability to economic stress.

Islamic Microfinance has traits to provide a parallel support to the poorest of the poor and its imminent qualities leaves no room for structural devastation as emphasizes ethical, moral & social factors to promote equality and fairness for the good of the society.

During the latest research on Microfinance sector, it is evaluated that Islamic financial system provides the best solutions for Poverty alleviation and Social sustainability, it is not only providing opportunity to utilize a sustainable system but also offers good rate of return & ideal performance compare to conventional microfinance system. Islamic Microfinance is a sub set of Islamic Economics and Financial System.

Global ISLAMIC MICROFINANCE FORUM SUMMARY

AlHuda CIBE has been conducting Global Islamic Microfinance Forum from last 11 years. This time, AlHuda CIBE will be holding the 12th Global Islamic Microfinance Forum on December 02 – 04, 2024 with Two Days Post Event Workshop on Practical Aspects of Islamic Micro, Agriculture and Rural Finance on December 03 – 04, 2024.

AlHuda is encouraging practitioners, microfinance institutions, donor agencies and Government Institutions by building up to acknowledgement of Islamic Microfinance System. It is providing a platform for dialogue between multilateral donor organizations and microfinance Networks to provide up to date knowledge of various aspects of Islamic Microfinance. This will promote Islamic financing for entrepreneurship and SME worldwide.

These are the reasons why these events are conducted internationally so that masses can enjoy its perquisites. State-of-art knowledge about Islamic Microfinance is shared in these forums through sessions, speeches and presentations designed under different tracks focused on active learning within the particular subject, participants can have a global perspective of micro financing.

More than 2,000 participants from around the world, from more than 65 countries participated in this series of conference from last 11 years. A number of industry well-known has participated in the series of conference