Event summary of 7th Global Microfinance Forum

With high hopes Alhuda CIBE has planned to conduct The 7th Global Islamic Microfinance Forum in Istanbul, Turkey on 24th -25th November 2017. The notion behind conducting these forums is to create awareness of Islamic Microfinance for the benefit of humankind and to help poor to survive at their best. This is the reason why these events are conducted internationally so that masses can enjoy its perquisites.

This year it is expected that the forum will unbolt new horizons, opportunities and innovation for Microfinance industry thus helping them eliminate poverty with support of Islamic Microfinance.

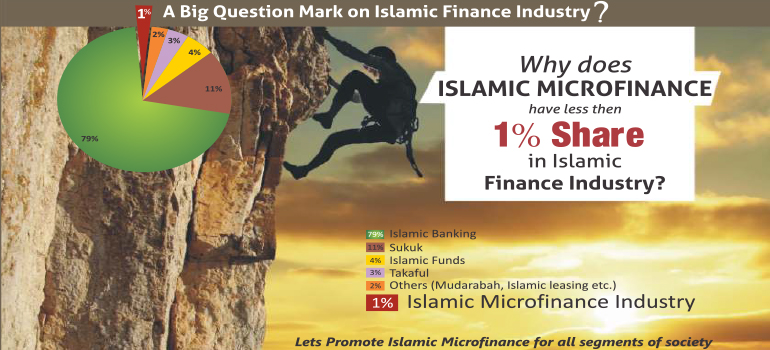

Islamic Microfinance

The issue of poverty has been a focus of international community. Everybody is talking about poverty reduction and different measures are being suggested for this purpose. People living in poverty need rapid access to a diverse range of financial services to run their businesses, build assets, ensure smooth self-consumption, and manage risks. Financial services for poor people have proven to be a powerful instrument for reducing poverty, enabling them to build assets, increase incomes and reduce their vulnerability to economic stress.

Islamic Microfinance has traits to provide a parallel support to the poorest of the poor and its imminent qualities leaves no room for structural devastation as emphasizes ethical, moral & social factors to promote equality and fairness for the good of the society.

During the latest research on Microfinance sector, it is evaluated that Islamic financial system provides the best solutions for Poverty alleviation and Social sustainability, it is not only providing opportunity to utilize a sustainable system but also offers good rate of return & ideal performance compare to conventional microfinance system. Islamic Microfinance is a sub set of Islamic Economic and Financial System.