AlHuda CIBE FZ LLE “Financial Inclusion Trough Enterprise Development for Poverty Alleviation”

AlHuda CIBE FZ LLE - U.A.E is committed to provide specialized Training, Advisory and Research Services globally with commitment, dedication, and aspiration to establish in the Islamic Banking & Finance industry since 2005.

Keeping the above vision in mind, AlHuda CIBE with its vibrant staff has been working with full dedication since 2005 for strengthening Islamic Financial System.

Brands of AlHuda CIBE include True Banking, Sukuk, and Centre of Excellence in Islamic Microfinance, Halal Research Council, Takaful Consultancy Wing, Islamic Microfinance News, Halal Newspaper and AlHuda Takaful Management System and AlHuda Today News.

AlHuda CIBE focuses to promote Islamic Microfinance worldwide, in order to alleviate poverty and to sustain the economic growth. Because of this principal, the recognition of AlHuda CIBE is increasing leaps & bounds.

ISLAMIC MICROFINANCE

The issue of poverty has been a focus of international community. Everybody is talking about poverty reduction and different measures are suggested for this purpose. People living in poverty need rapid access to a diverse range of financial services to run their businesses, build assets, ensure smooth self-consumption, and manage risks. Financial services for poor people have proven to be a powerful instrument for reducing poverty, enabling them to build assets, increase incomes and reduce their vulnerability to economic stress.

Islamic Microfinance has traits to provide a parallel support to the poorest of the poor and its imminent qualities leaves no room for structural devastation as emphasizes ethical, moral & social factors to promote equality and fairness for the good of the society.

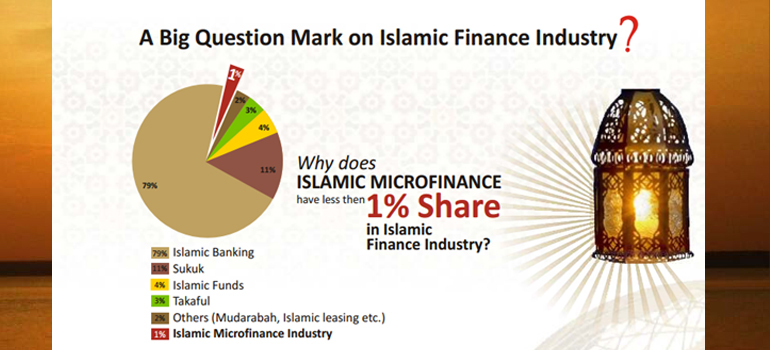

During the latest research on Microfinance sector, it is evaluated that Islamic financial system provides the best solutions for Poverty alleviation and Social sustainability, it is not only providing opportunity to utilize a sustainable system but also offers good rate of return & ideal performance compare to conventional microfinance system. Islamic Microfinance is a sub set of Islamic Economics and Financial System.

Global ISLAMIC MICROFINANCE FORUM SUMMARY

AlHuda CIBE has been conducting Global Islamic Microfinance Forum from last nine years. This time, AlHuda CIBE will be holding the 10th Global Islamic Microfinance Forum on December 12, 2021 with Two Days Post Event Workshop on Practical Aspects of Islamic Micro and Rural Finance on December 13 -14, 2021 in Dubai, UAE.

AlHuda is encouraging practitioners, microfinance institutions, donor agencies and Government Institutions by building up to acknowledgement of Islamic Microfinance System. It is providing a platform for dialogue between multilateral donor organizations and microfinance Networks to provide up to date knowledge of various aspects of Islamic Microfinance. This will promote Islamic financing for entrepreneurship and SME worldwide.

These are the reasons why these events are conducted internationally so that masses can enjoy its perquisites. State-of-art knowledge about Islamic Microfinance is shared in these forums through sessions, speeches and presentations designed under different tracks focused on active learning within the particular subject, participants can have a global perspective of micro financing.

More than 2,000 participants from around the world, from more than 60 countries participated in this series of conference from last 9 years. A number of industry well-known has participated in the series of conference.

Poverty alleviation is an important objective for all nations on earth. Unfortunately, in many countries poor people who are caught in the vicious cycle of abject poverty lack collateral, savings, education and credit necessary to engage in meaningful economics activities. Government policies, facing limited resources and competing ends are often inadequate in providing financial assistance to the poor Conventional financial institution do not offer loans to the destitute often because of high operating costs and those that do, for example the Gramen Bank in Bangladesh, end up charging prohibitively high-interest rates to cover their expenses (UNDP, 2012). The result is that economic growth remains concentrated in few urban areas, and it fails to benefit the poor, especially in rural areas.